Designing a Scalable Real Time Stock Price Streaming System

Designing a Scalable Real Time Stock Price Streaming System

Real-time stock price streaming is one of the most challenging backend problems because it involves:

- High-frequency data ingestion (from exchange feeds)

- Continuous real-time delivery to thousands (or millions) of users

- Efficient time-series storage

- Infinite incoming data

- Low-latency push to web and mobile clients

- Cost-efficient long-term archival

In this article we’ll design a complete end-to-end system that can power a lightweight stock market app or even scale up to hedge-fund level infrastructure.

We will explore:

- WebSockets vs Server-Sent Events (SSE)

- Database choices & trade-offs

- Handling infinite streaming data

- Hot/Warm/Cold storage strategies

- A production-grade architecture design

- Horizontal scaling

- Full system diagrams (ASCII + Mermaid)

Let’s begin.

1. Real-Time Updates: WebSockets vs SSE

A stock app needs to push updates to users in real-time. There are two main communication options:

WebSockets

WebSockets are full-duplex, meaning the client and server can talk to each other at any time.

✅ Pros

- Very low latency

- Bidirectional

- Efficient for high-frequency streaming

- Supports binary formats (ProtoBuf/CBOR)

- Stable across mobile networks

❌ Cons

- Must implement heartbeats (ping/pong)

- Risk of zombie connections if not cleaned

- Requires sticky sessions when load-balanced

- Slightly more complex than SSE

Server-Sent Events (SSE)

SSE is unidirectional (server → client) using HTTP streaming.

✅ Pros

- Simpler than WebSockets

- Auto-reconnect built-in

- Uses HTTP—easy to debug

- Ideal for one-way updates

❌ Cons

- Client cannot push messages back

- Text-only (no binary)

- Can break often on mobile networks

- High-frequency streams (50+ msgs/sec) struggle

Which should we choose?

| Requirement | Winner |

|---|---|

| High-frequency updates | WebSockets |

| Unidirectional updates | SSE |

| Mobile stability | WebSockets |

| Simplicity | SSE |

| Bidirectional communication | WebSockets |

For a stock app → WebSockets are the strongest long-term choice.

But we will design the system to support either.

2. Ingesting Tick Data from Exchanges

Most stock exchanges publish data via:

- FIX feeds

- WebSocket streams

- Proprietary streaming protocols

- Kafka-based market data feeds

Your backend will subscribe to a real-time tick data stream like this:

AAPL → 190.45

TSLA → 241.12

MSFT → 329.01

These events come in continuously and infinitely.

3. Database Choices for Tick Data

Tick-level market data is extremely high volume:

- Thousands of ticks per second

- Millions of rows per day

- Billions of rows per year

Not all databases can store this.

Let’s compare options.

A. TimescaleDB (based on PostgreSQL)

Great for:

- Time-series queries

- SQL familiarity

- Retention policies

- Compression

Limitations:

- Horizontal scaling is manual

- Not ideal for >100K writes/sec

- Storage still fills unless you prune data

B. ClickHouse

Best columnar analytics database in the world.

Pros

- Writes millions of rows/sec

- Extremely compressed storage

- Built-in sharding & replication

- Perfect for large tick datasets

- Querying is blazing fast

Cons

- Horizontal scaling is not fully automatic

- Old data must be manually tiered or moved to S3

C. QuestDB

Insanely fast ingestion, optimized for time-series.

Cons

- No clustering

- Single-node only

- Not good for infinite long-term storage

D. Redis (not for history)

Redis is not your primary database.

Use Redis only to store:

- Current price of each symbol

- Last X seconds/minutes of data (cache)

It supports instant lookup for WebSocket updates.

E. Cassandra / ScyllaDB (infinite scale, limited analytics)

Cassandra provides:

- Automatic horizontal sharding

- Infinite storage scaling (via consistent hashing)

But:

- Not columnar

- Not ideal for analytical queries

- Expensive for ad-hoc history lookups

4. Why You Cannot Store Infinite Tick Data in Any DB

Here’s the truth:

No time series database can store infinite tick data forever, even with sharding.

There will always be:

- Disk limits

- Retention constraints

- Cluster rebalancing challenges

- Costs that grow linearly or exponentially

So real financial systems use data tiering.

5. Solving Infinite Data: Hot/Warm/Cold Storage

🔥 Hot Storage (real-time)

- Redis

- In-memory

- Last 50–100 ticks

- Millisecond latency

- Used by WebSocket/SSE servers

🌤️ Warm Storage (recent history)

- ClickHouse / TimescaleDB

- Keep 7 days – 30 days of raw ticks

- High compression

- Fast analytics

❄️ Cold Storage (long-term archival)

- S3

- Glacier Deep Archive

- Parquet/ORC files

- Extremely cheap

- Used for: compliance, ML models, historical charts

6. Data Lifecycle

- ✔ 1. Ticks enter Kafka

- ✔ 2. Processor writes ticks to ClickHouse (30 days retention)

- ✔ 3. Every N hours:

- compress old partitions

- dump old data to S3 as Parquet

- ✔ 4. Delete old partitions in DB

- ✔ 5. Update Redis with latest prices

- ✔ 6. WebSocket servers broadcast to clients

This is the architecture used by:

- Robinhood

- Binance

- Coinbase

- Bloomberg Terminal

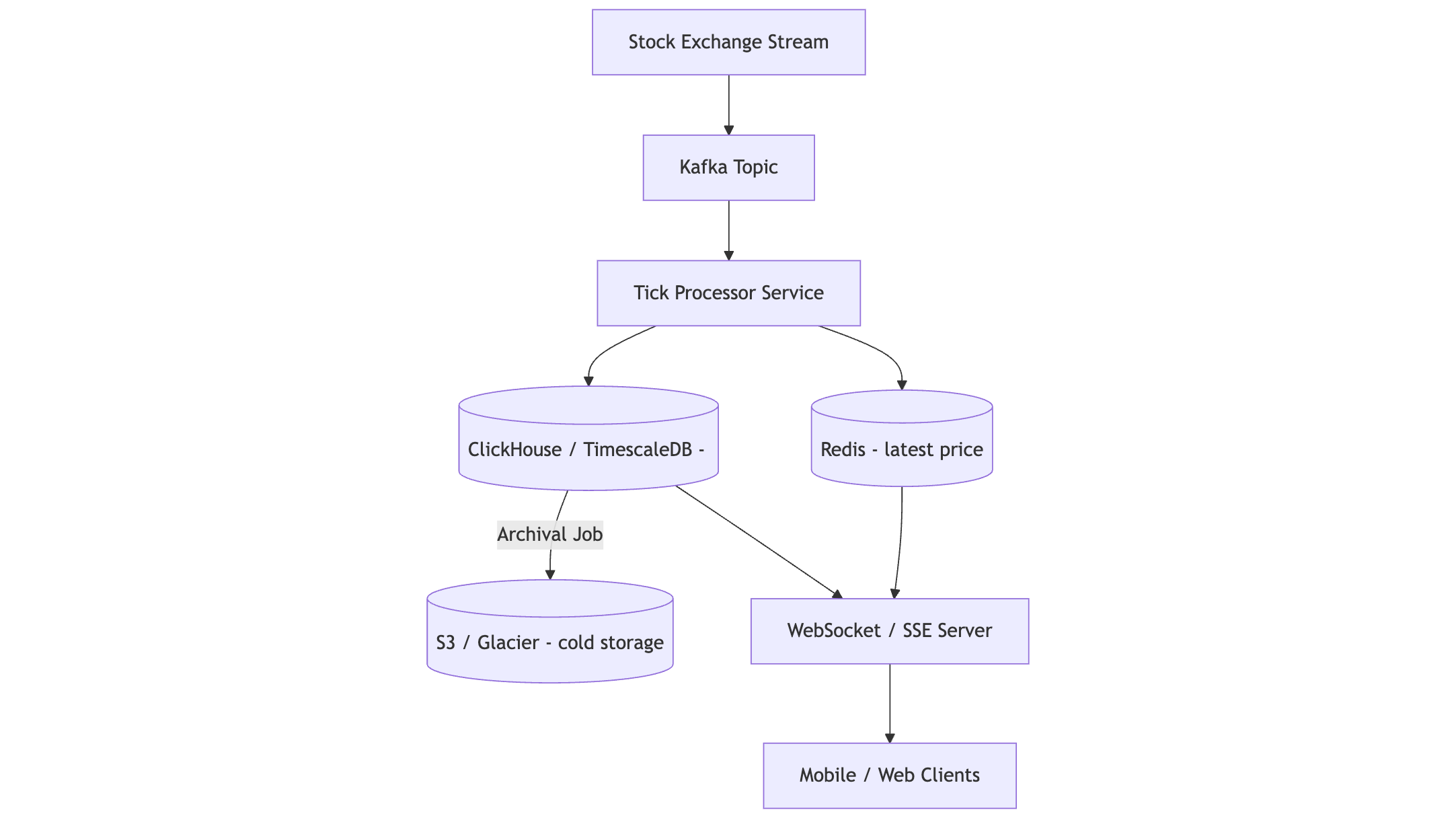

7. Final System Architecture

Below is a complete end-to-end architecture.

Design Diagram

8. How Clients Receive Updates

- Option A — WebSockets

- Persistent connection

- Bidirectional

Ideal for frequent updates and mobile networks

-

Option B — SSE

- Unidirectional

- Auto-reconnect

Works well for dashboards

Both work, but WebSockets handle real-time stock prices better.

9. Scaling the System

Horizontal Scaling Made Easy

- Multiple Kafka consumers

- Multiple WebSocket server instances

- Redis used as central cache

- ClickHouse cluster (2–8 nodes)

- S3 for infinite retention

- Load Balancing WebSockets

- Enable sticky sessions so each client session stays on the same node.

10. Summary

- ✔ Real-time delivery → WebSockets

- ✔ Latest prices → Redis

- ✔ Warm storage → ClickHouse / TimescaleDB

- ✔ Cold infinite storage → S3 + Glacier

- ✔ Ingestion → Kafka

- ✔ Cleanup → Retention policies + archival jobs

This architecture:

- Scales Horizontally

- Cost Efficient

- Handles Infinite Data

- Performs well at real-time speed

- Matches real-world stock market platforms